RealtyCast Global #10: Navigating Expat Life and Real Estate Investing in Belize with Michael Cobb

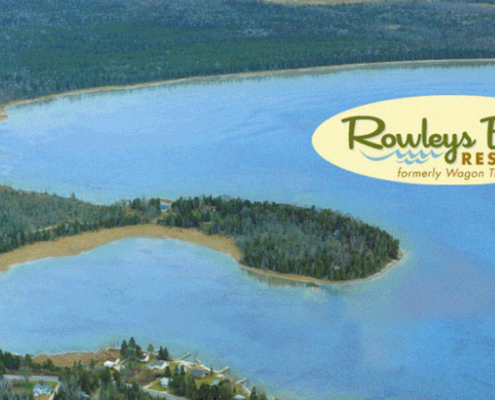

Welcome to episode #10 of RealtyCast Global – a global connection to all things real estate, hosted by Hugh Gilliam, president of Global Property Pros. Belize, often referred to as Mother Nature’s best-kept secret, is quickly becoming one of the most intriguing destinations for global investors and expatriates seeking a slice of paradise combined with […]

Photo by Tierra Mallorca on Unsplash

Photo by Tierra Mallorca on Unsplash