20 Trends from the 1920’s to Watch in 2023

Glamorous. Luxurious. Sophisticated.These are typically the words used to describe interior design in the 1920’s and we’re excited to say that when it comes to home design, what’s old is new again! While the roaring 20’s were fun last time, we’re in for a real treat as we welcome 2020. Here are 20 home interior trends from the 1920’s that we see making return in the coming decade.

Cats and dolls, ladies and gents, RealtyHive presents

20 Trends from the 1920s to Watch in the 2020s

1) Bold Colors

The Kardashian-West clan can keep their neutrals. The last few years have been filled with ubiquitous gray-walls-with-white-trim, so expect to see some real punches of color. Think less bright and in-your-face and more rich, luxurious, and deeply toned hues.

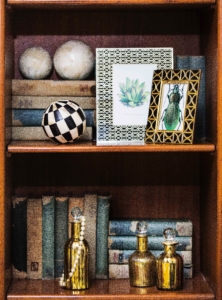

2) Metallic Surfaces & Accents

We thought the new millenium would bring chromed-out everything, but thankfully that was just some Hollywood fortune telling. There was a brief love affair with mercury glass and galvanized, especially galvanized corrugated metal came in with the farmhouse aesthetic of the 2010s, but expect more metal in the 2020s. We’re calling classy colors like gold, black and bronze in shiny or matte, but not weathered or worn, finishes.

3) Freestanding Bathtubs

Freestanding baths all but disappeared from the 1970s and 2010s in favor of shower/bath combos and jetted tubs, but the clean look and unparalleled luxury of a freestanding soaking tub will make this trend return in the 2020s. Plan on this new iteration having less of a clawfoot style and more of a sleek, minimalistic look.

4) Large Velvet Furniture

We’ve been seeing velvet on smaller items like headboards and ottomans for years, but, really, what says “roaring 20’s” more than a full velvet couch in a bold midnight blue or luxe emerald green?

5) Worldly Prints & Touches

The 1920s saw designers and stylemakers looking to far away lands for design inspiration — which led to some ethically questionable behavior in terms of sourcing, acquisition, and more. As globalization becomes more and more the norm, expect to see more of east-meets-west look in homes — but with an eye for ethical, humanely sourced, and sustainable goods.

6) Earthy Prints & Textures

This one, too, has been going for a while, but don’t expect to toss your banana leaf print or hemp macrame quite yet. Do expect to see these more natural and bohemian items paired with the rich colors and metals listed above for a look that is all it’s own style in 2020.

7) Form-function-forever

After decades of consumerism, planned obsolescence and disposable single use products, we’ll see a return to higher cost, but higher quality, long term products. Multifunctional items that are built to last with a beautiful (some may say Instagrammable) aesthetic will dominate this decade — even if they come at a higher price point. Think companies like Le Creuset (founded in 1925) and Rubbermaid (1920), but this trend isn’t just limited to the kitchen.

8) Dramatic Design

The 2020’s, like the 1920’s, will be an era for gender-bending style fluidity (remember it was scandalous for ladies to wear pants at that time). This time around we’ll see norm breaking in home design — think lace mixed with leather and metal, rich wood with sparkling crystal combined with marble — a slew of feminine-meets-masculine-with-androgynous touches all done with a heavy flair for the dramatic and no time for minimalism.

9) Tortoise Shell

While we’re not really sure tortoise shell patterns ever went away, expect it to come back in force in the 2020s. The typical black-and-brown color palette means it coordinates with everything and the unique, yet classic pattern gives it an exotic, yet familiar feel. Look for touches of tortoise shell paired with metallics and matte jewel tones in unexpected, yet charming places.

10) Rugs, Rugs, Rugs

We’ve long said “ado” to busy, patterned linoleum and “adios” to wall-to-wall shaggy and oddly colored carpets in favor laminate and hardwood flooring, but unlike the sleek minimalist look of the 2010s, we’re calling for the return of rugs. Staircases and hallways will feature striking runners while area rugs will draw the whole room together. These aren’t your mother’s put-your-shoes-by-the-door floormats, instead these are designed to be statements of their own. Feeling extra bold? Try a LARGE circular rug for enhanced drama.

11) Sunburst designs

The art deco that defined the 1920’s shines in sunburst designs. Often found in mirrors and wall art, this fun and sunny shape will find new life in the home and looks especially fresh being incorporated into a nursery!

12) Wallpaper

Another trend we’ve seen coming back in the last few years is wallpaper, especially the heavily patterned or textured variety. Unlike the cover-all-walls method of the 1920’s, this time around wallpaper will be used as an accent wall. Unsure you’re ready to commit or still waiting to purchase your own place? These days you can get the same luxe look with far less commitment by using peel-and-stick contact paper.

13) Displayed Smoking & Vaping Paraphernalia

The 1920’s was the golden age of cigarettes in America with many women picking up the habit during World War I. Coffee tables often displayed cigarette boxes or urns, match strikes, lighters, and opera length cigarette holders. Nowadays traditional cigarette smoking is in decline, but vaping and increasing marijuana legalization means in the 2020s you’re likely to see a renaissance of sorts of this trend.

14) Art Deco

The combination of modernist styles with fine craftsmanship and rich materials make this style just as relevant today as it was in the 1920s. At its inception, Art Deco was meant to represent luxury, glamour, exuberance and optimism and had an international appeal — all things that make for good design today. Forget the opulence of, well everything, in the 1980s or the over-the-top design of the Tuscan kitchens of the 2000s, Art Deco feels both fresh and vintage, new and classic.

15) Geometric Furniture

Kneeling to the Art Deco trends that shaped the 1920s, expect to see more clean lines and interesting shapes in furniture in the 2020s. Note that the new version of this look comes in new variations (lights, bookshelves, tables, you name it!) and to get the best impact for your effort you should limit items to having a fun shape or pattern– lest you take on a Peewee’s Playhouse feel.

16) Grown-up Glitz

No glamourous style is complete without at least a little glitz and glimmer and the 2020s will not disappoint. Taking inspiration from glitzy “flapper” style of the 1920s, you can expect beaded upholstery, mirrored accents and even crystal fireplace glass rocks to turn up the shimmer in the 2020s.

17) Large Scale Items

The bold and patterned nature of design in the 1920s means that every piece in a room is competing with the piece next to it, so embrace it.While the last few years have seen a surge in the popularity of the gallery walls, in the 2020s expect to see bigger, singular pieces of wall art.

18) Horizontal multi-panel doors

After a decade, get ready to say “goodbye” to the barn door look and “hello” to solid wood doors with more interesting panels routed into them. Unlike the traditional 6-panel door look that has two rows of three vertical panels, this version may have different designs or windows added and aren’t just reserved for the front entryway.

19) Built-in Furniture

Built-in furniture all but disappeared in the last few decades as homes and buildings were purposely designed to have the greatest appeal to the largest amount of people. Gone was the character of the 1920s built in designs, but now we’re coming full circle. These days you can achieve the built in look without the built-in hassle by using smartly designed bookshelves.

20) Statement Fireplaces

During the 2010s we saw fireplaces all but disappear, that is to say visually disappear. While the function (usually) remained, the form was often painted over in an effort to blend the fireplace into the wall that held it. This decade, expect another throwback look to emerge with bold fireplaces retaking center stage in rooms.

RealtyHive Wrap-Up

When designing your home, remember that trends come and go, but style is forever. Choose pieces that fit your style, your life, and your budget and you’re sure to create a beautiful space you’ll love for years to come.

Ready to start creating your perfect space in 2020? Whether you’re looking for a move-in ready Spanish-style home or you’ve got your eye on a vintage commercial building RealtyHive has you covered. Have a property to sell? Check out the great options available for sellers on RealtyHive!