We’re RealtyHive and This is Our Story

As an entrepreneur I’ve always been fueled by a desire to improve business systems. In the 1980’s Real Estate offered me an opportunity to improve processes and systems, and I dove in headfirst, determined never to look back. Early on in my career I became one of the top real estate brokers in the nation, winning various awards, speaking in panels, and attending tons of real estate engagements.

Then in 2000, opportunities with a great group of professionals led to break ground as a co-founder of Nicolet National Bank, which later became the fastest-growing bank in Wisconsin.

When the real estate market crashed in 2009 and disrupted the entire industry as we know it. Though it was devastating, it was the catalyst that made RealtyHive what it is today.

RealtyHive Was Born From The 2009 Real Estate Crash

During the crash, tons of properties were coming back into banks, and the banks wanted to do what was in the best interest of their shareholders.

In an effort to mitigate the loss on properties, I knew I needed to create a platform to help get as much exposure as possible to potential buyers, making sure the banks could close deals faster.

Later that year, I teamed up with devoted visionaries to create the RealtyHive platform where sellers and agents can market their properties, create more awareness and close at a higher rate, using our unique marketing systems:

- “Marketing Matters:” Marketing Matters is RealtyHive’s outbound marketing program that promotes the property to a sea of various global platforms, bringing more impressions, direct property views and leads. The best part is you pay nothing unless your property sells!

- “Time-Limted Events:” This process allows sellers to retain full control of the final sales price. By using a Time-Limited Event, RealtyHive helps increase competition and create urgency for potential buyers which means you can close a deal faster.

Today, RealtyHive is responsible for selling thousands of properties while serving the real estate community in the private, agency, and banking sectors. Check out some of our case studies:

- Great Falls Property Sells With Over 54,000 Impressions on RealtyHive

- RealtyHive Commercial Property Sold at 113% of The Suggested Opening Bid

- Property Sells in a Month on RealtyHive!

I firmly believe the RealtyHive platform and marketing process have revolutionized purchasing and selling real estate in a way that’s consistently optimized to utilize the best internet, media, and print resources across local and international markets. The result is a unique marketing solution that gives buyers and sellers the power to speed up the sale—a win-win scenario.

Then RealtyHive Implemented Cashifyd, a Cashback Program for Real Estate

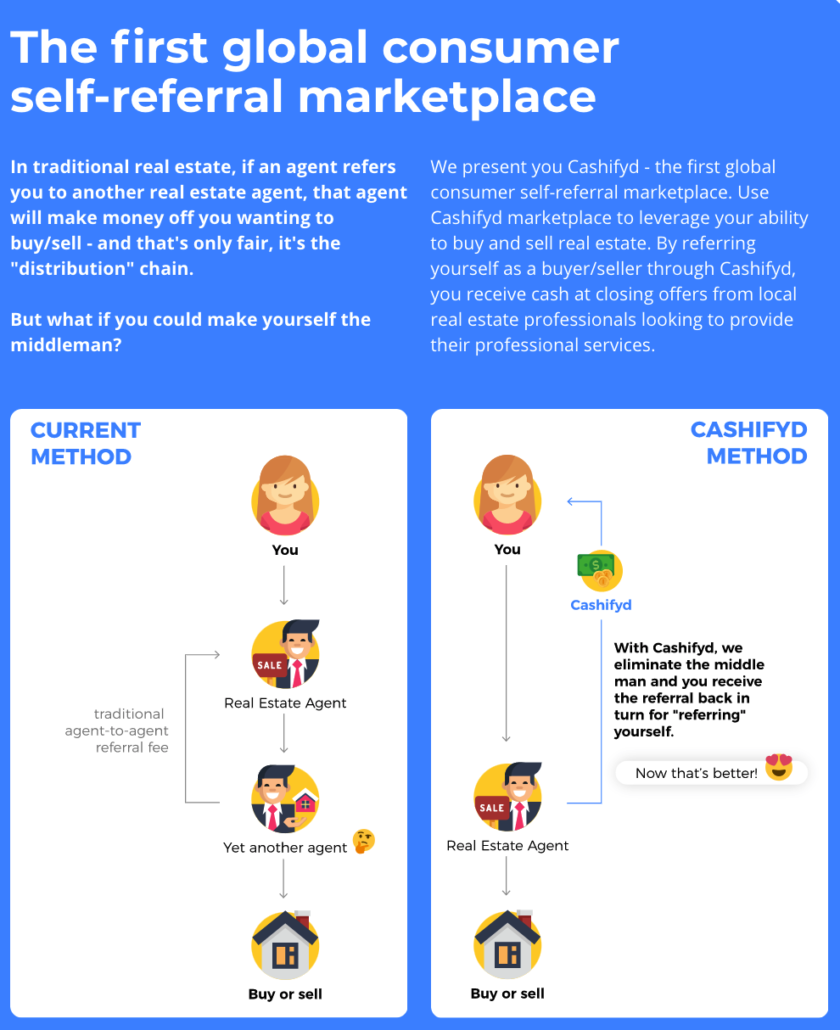

As a platform that connects buyers to agents and sellers, we took a deep dive into our competitors to improve our platform and distinguish ourselves. When a buyer uses Zillow for example, they fill out a form, then get inundated by agents all fighting to sell you a property.

To be honest, it’s overwhelming for the buyer and not a great consumer experience.

Regardless, it satisfies Zillow because it’s their job to create leads and pass them off to the agents to receive a referral or ad fee as the middle man—regardless if it’s a positive user experience for the buyer.

We wanted the RealtyHive platform to be a consumer advocate, which meant we needed to remove the “middle-man” structure and empower the consumer by giving them their own referral fee in the form of cashback.

I took this concept and created the RealtyHive Cashifyd Program—the first global consumer self-referral marketplace for real estate. Here’s how it works:

Ultimately, we want the consumer to be in control, so we reward you as the consumer for your own lead and it’s free to use.

Join The RealtyHive Mission and Vision By Investing on Wefunder

Our plan is to be the global platform to connect buyers and sellers, in a way that empowers the consumers.

We are currently fundraising on Wefunder to speed up the development of features and functions that will enable us to get directly in front of agents with properties and put the best information in front of all parties in the transaction.

We think there’s a huge opportunity to partner with the community of people who share our vision of changing the real estate landscape. We want to bring you all into the innovative process, and everything that comes with being on our team, including giving you the opportunity to own shares in RealtyHive.

If you want to invest in a company that has an exciting future and will make a difference in real estate, then join RealtyHive’s equity crowdfunding campaign. Your investment will make you an owner of our company so you can make a difference while also benefiting from our success.

We encourage you to invest in RealtyHive today and join our mission as an investor! If you have questions, please leave them in the Comments section of our campaign page and our team will be sure to address them as soon as possible.

Wade T. Micoley

CEO/RealtyHive