How to Become a Real Estate Agent

Thinking of making a career change? If being your own boss, seeing beautiful homes, and helping people achieve their dreams sounds great, becoming a real estate agent should be in your cards. Take a look at the process, pros and cons of agent life to see if it’s the right career move for you.

The Process of Becoming an Agent

Steps to Becoming a Real Estate Agent

- Study your state’s agent licensing requirements.

Every state has different requirements. It’s important to see what’s expected of you before diving in. Keep in mind, you can become licensed in multiple states as well.

- Take a prelicensing course.

Find a school with a good reputation and an equally good track record for post-graduates.

- Apply for your real estate salesperson exam.

Each state has specific rules on when you can take this exam and whether or not you qualify. Some states require background checks and fingerprints which take awhile to process — know what you need to submit far in advance before you actually are ready to take the test.

- Pass the exam

Hopefully you’ve studied and feel confident for your exam, but it’s OK if you don’t pass it the first time — you can retake it.

- Find a broker.

Every agent legally needs a broker. Even though agents can also become real estate brokers, it’s best to interview multiple brokers and find one to work with (especially when you’re just starting out). After a sale, you will pay this broker through something called “commission splits.”

The Pros of Becoming a Real Estate Agent

You’re an independent contractor. You get to set your own rules! Take vacations when you want, work when you like — you set the pace for your work.

You get to work with others. Becoming an agent is a great job for anyone who loves working with people. While challenging, it is insanely rewarding to help people fulfill their dreams of owning a home.

You learn a ton of valuable knowledge. Knowing the ins and outs of real estate is immensely helpful when you’re looking to buy or sell your home.

You don’t need to go to college. While you have to take a prelicensing course, it’s much less expensive than paying for tuition. The course cost ranges by state but is usually $500 to $2,000.

You can start at the age of 18 or 19. Most decent paying jobs are unavailable to the youngest adults, but that’s not the case with agents. As long as you’re an adult who is also a legal resident, you hit the basic criteria for becoming an agent (though, as mentioned, you might have to also pass a background check, depending on state).

The Cons of Becoming a Real Estate Agent

Before diving in, we’d just like to point out that many of these “cons” could also serve as “pros,” depending on the person and the situation.

You won’t have any benefits. While there are some definite advantages to becoming an independent contractor, one of the biggest downsides is not having benefits. You’ll have to provide your own health insurance and set up a retirement fund.

You’ll need a solid network. If socializing and networking are your cup of tea, this isn’t a negative. However, you will struggle as an agent if this isn’t the case. Those living in rural areas or who just moved to a new city will definitely have an uphill (though not impossible) battle.

You probably won’t make as much as you think. At least, not at first. In fact, the median annual salary for a Realtor with 2 or fewer years of experience is $9,300. This leads us to our next point:

Most people aren’t full-time agents. Again, this isn’t necessarily a negative, but whether it’s because of the work, the time, or the lack of income (or all three), most people do other work on top of being an agent. It’s important to note that many agents don’t re-up their license once it expires for the first time (after five years).

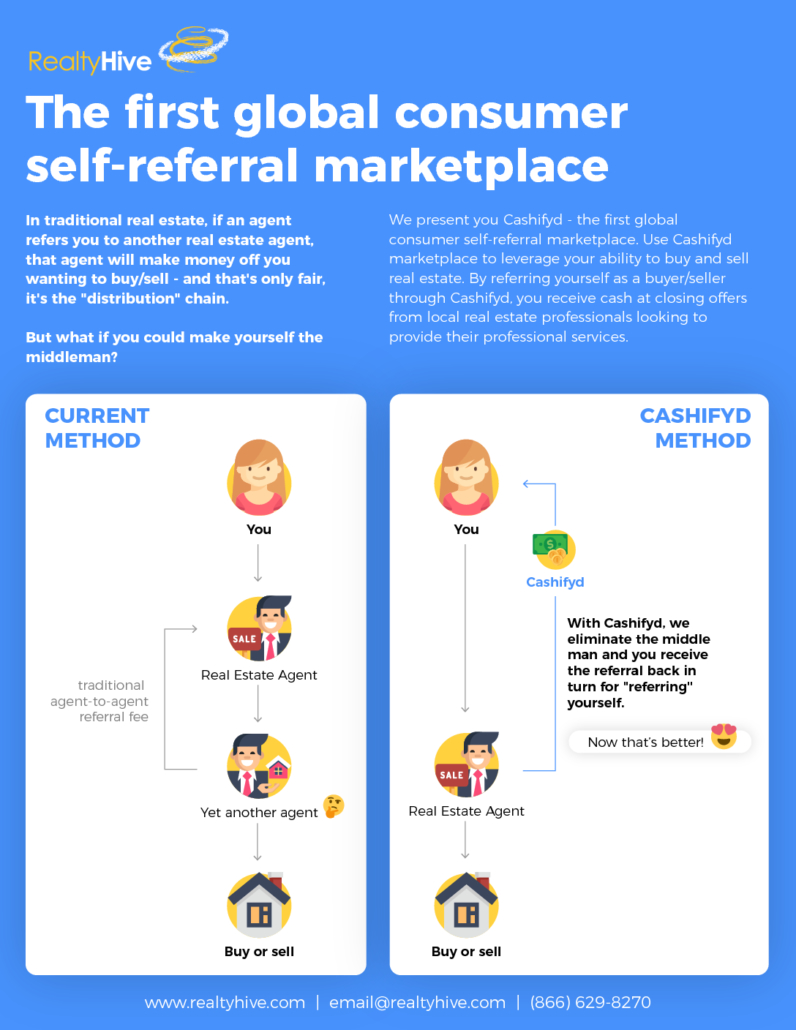

While there are both pros and cons to becoming a Realtor, don’t let the negatives discourage you! RealtyHive works with agents, buyers and sellers alike. We can help you stand out in your market, differentiate from the competition and sell more properties. Become a member, market your properties, or represent a buyer with RH.